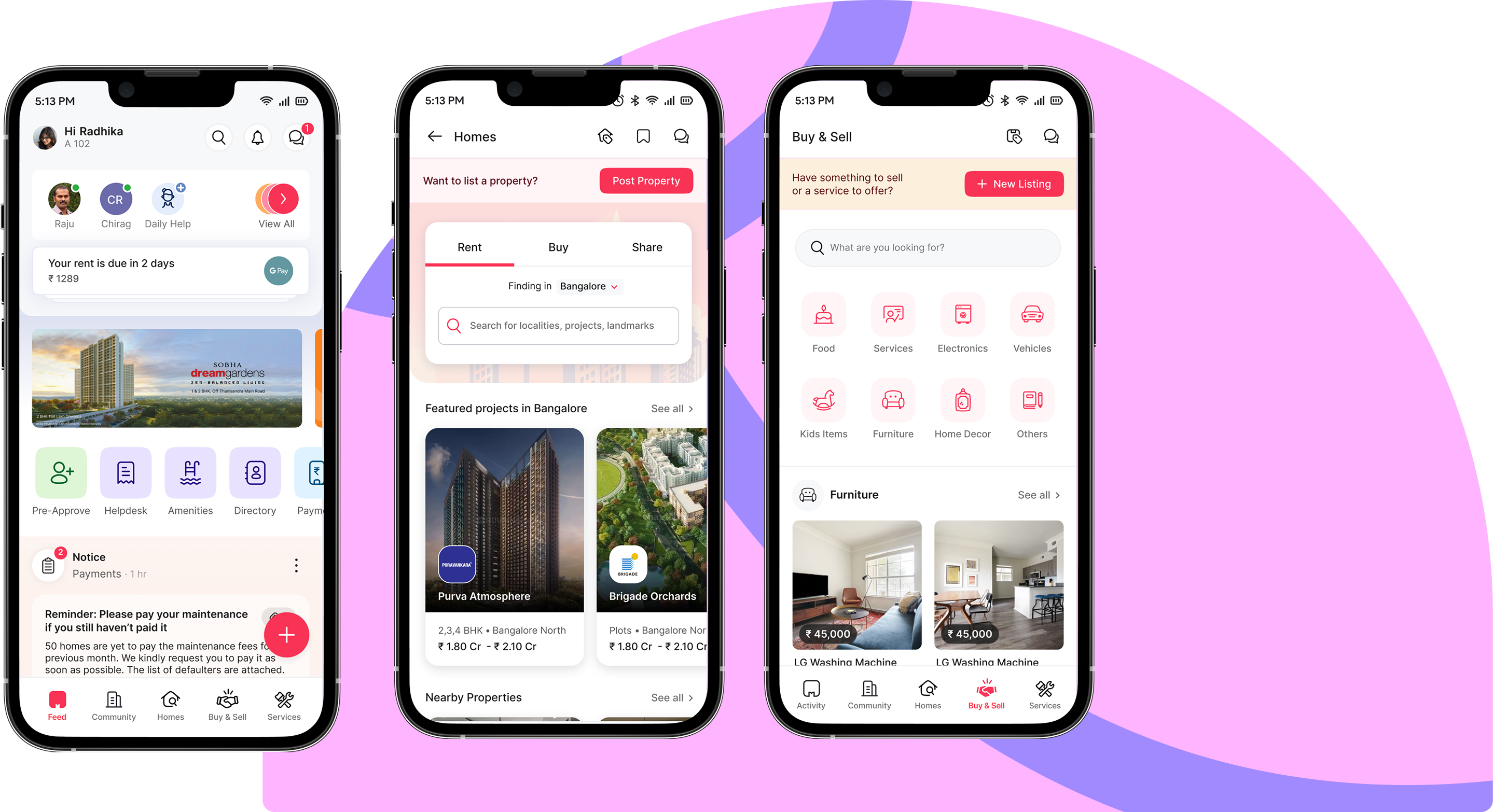

Mygate Resident App

Led the efforts to completely redesign the application, solving existing UX gaps and enabling further business growth.

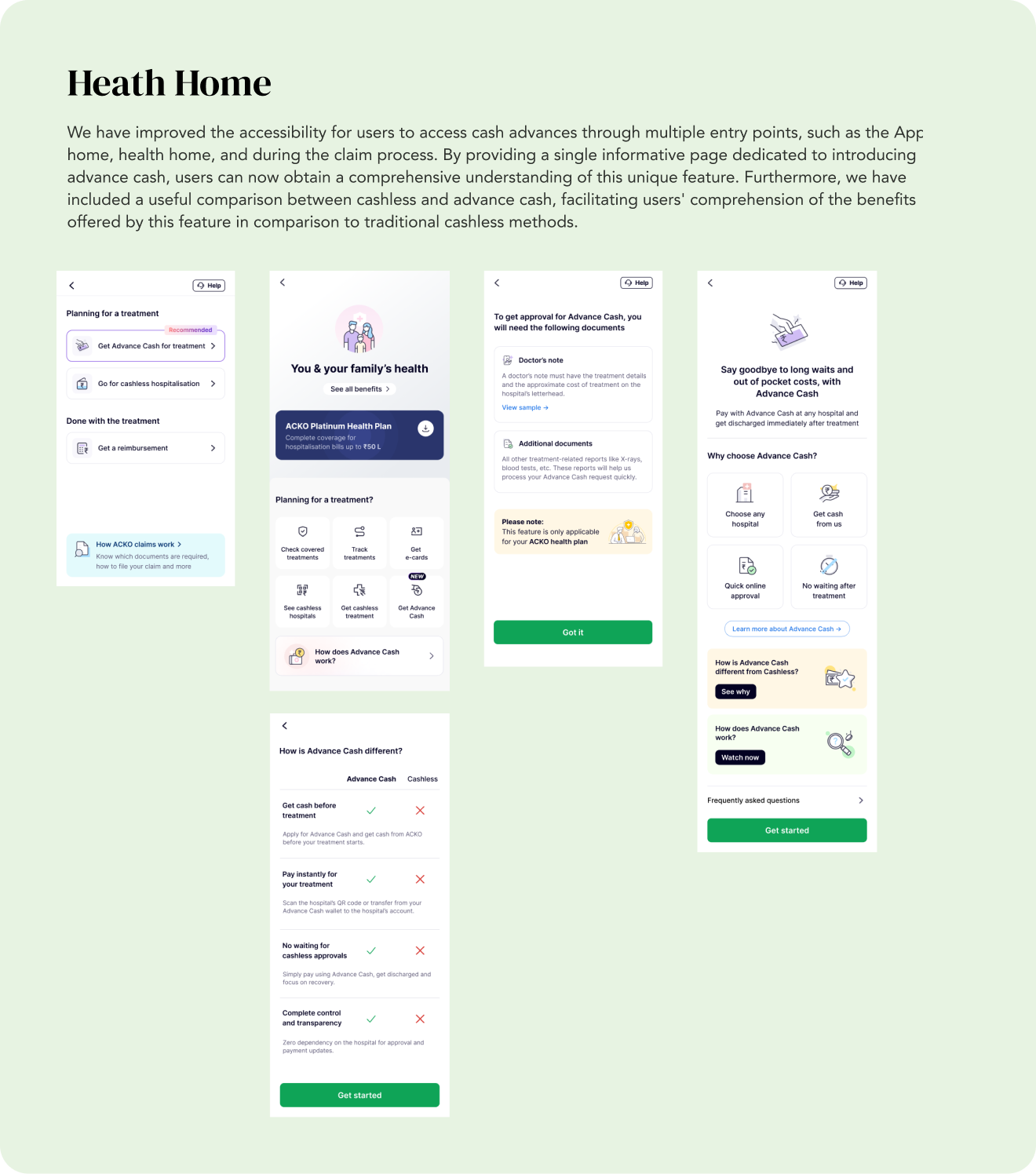

Read MoreMy goal is to create an exceptional insurance experience for all our customers at ACKO. We want to make cashless insurance available for all services, whether at network or non-network hospitals, and establish an independent claims processing network to improve efficiency and customer satisfaction.

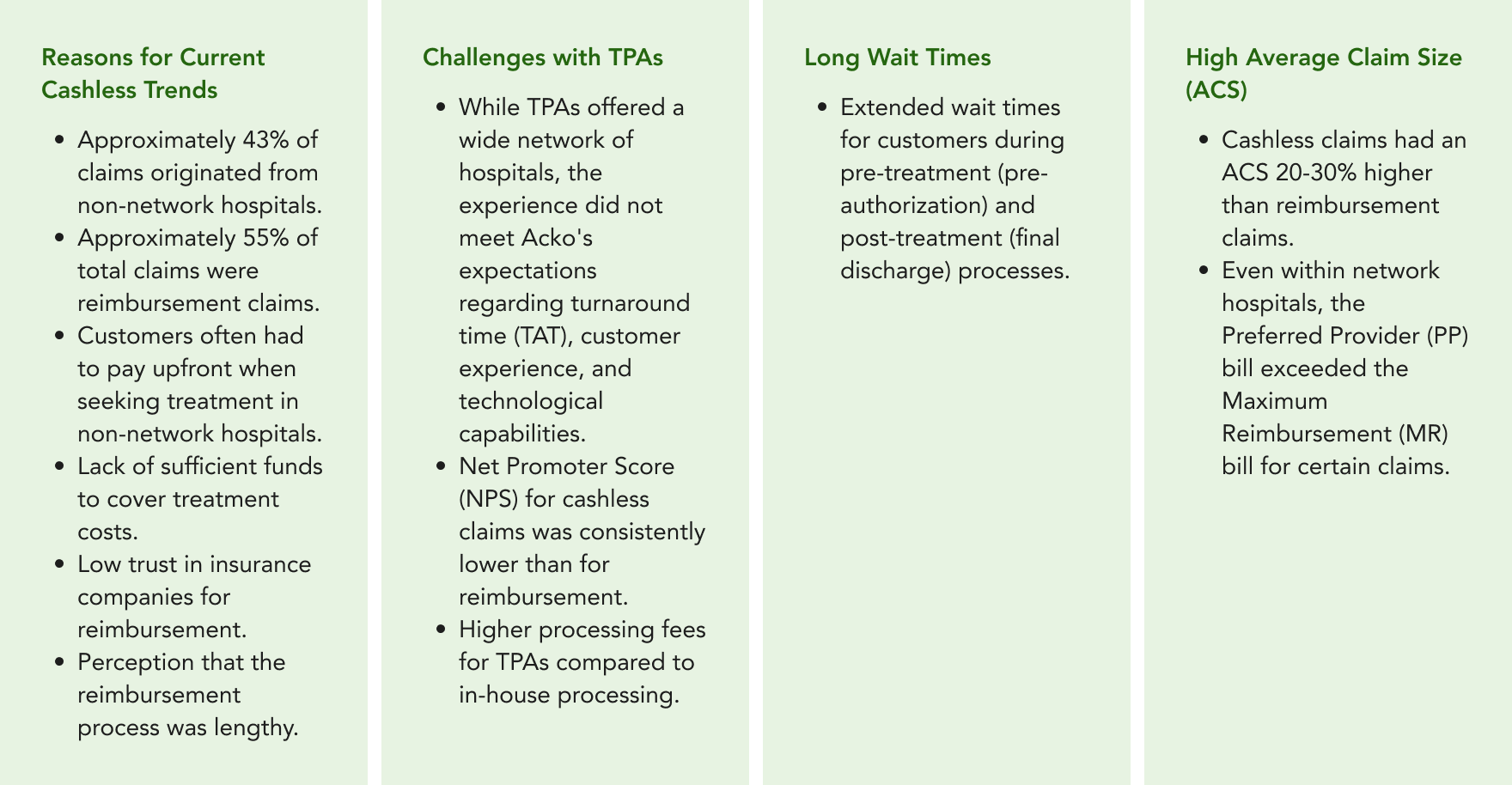

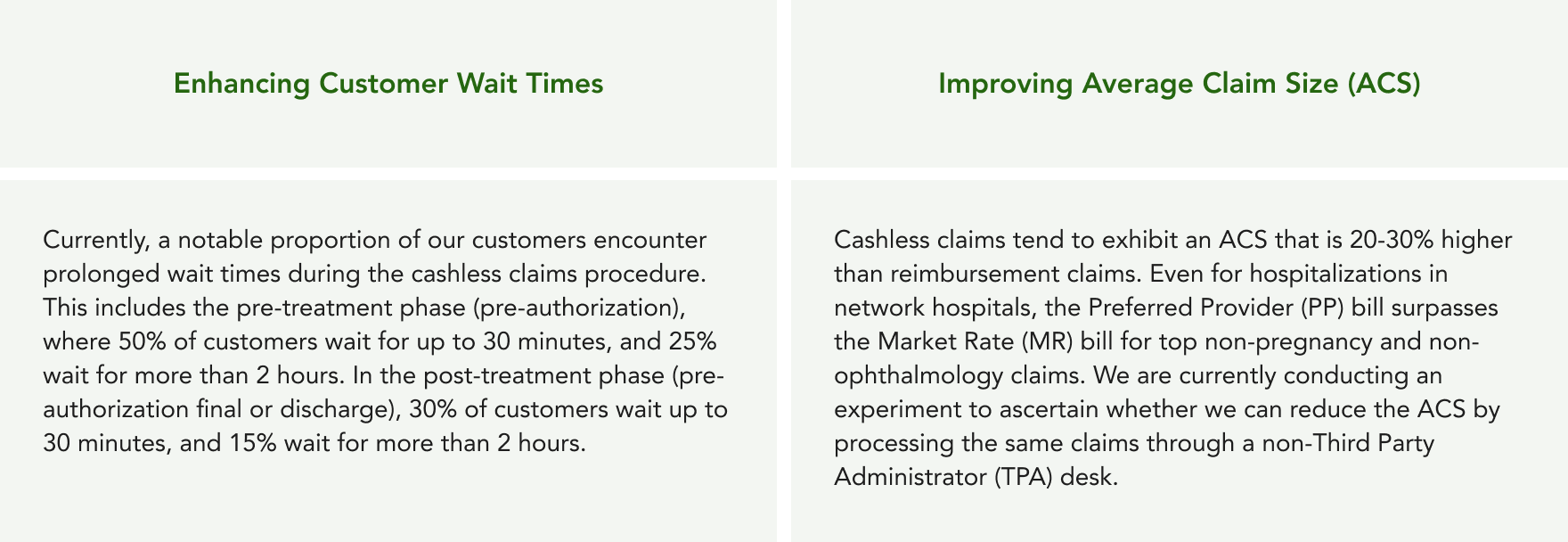

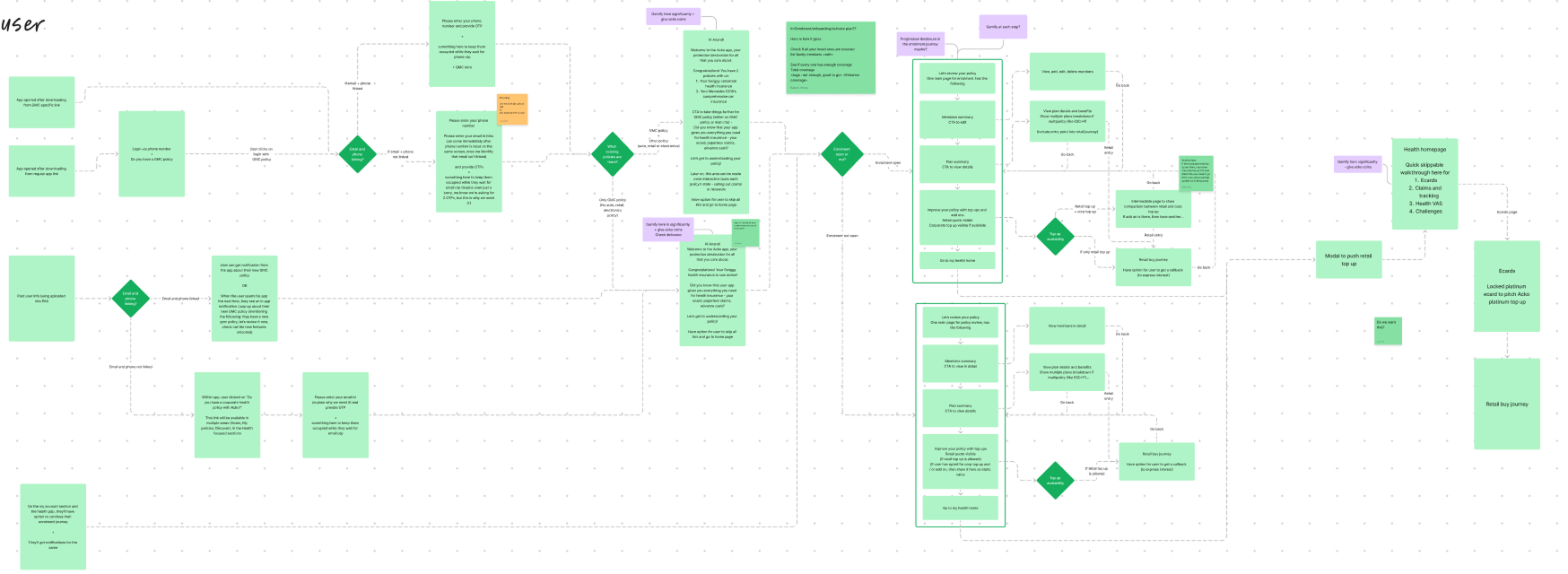

The problems we aim to address are why customers prefer cashless options and why we, at ACKO, want to enhance this process. Many customers prefer cashless claims to avoid upfront expenses, especially at non-network hospitals. They may also lack trust in the reimbursement process.

We want to improve the cashless experience because while TPAs offer a wide hospital network, the overall experience often falls short. We're also paying significantly more to TPAs for cashless claims processing compared to in-house processing.

So the Goals of this project can be summarised as

Exploring Alternative Options for Enhanced Efficiency in Cashless Claims Processing, Beyond Third-Party Administrators (TPAs)

Third-Party Administrators (TPAs) offer notable advantages in terms of an extensive hospital network and streamlined coordination for cashless claims processing. However, our experience with TPAs has not aligned with our expectations in terms of Turnaround Time (TAT), customer experience, and overall technological capabilities. The Net Promoter Score (NPS) for cashless claims, on average, falls behind that of reimbursements by 10%.

Furthermore, there exists a significant cost disparity to consider. Presently, we incur a payment of Rs. 1650 to TPAs for the processing of cashless claims, while our in-house processing, inclusive of a system usage fee of Rs. 450 paid to TPAs, amounts to approximately Rs. 1000-1100.

Acko identified several issues within the existing cashless insurance system:

Our objectives encompass the following:

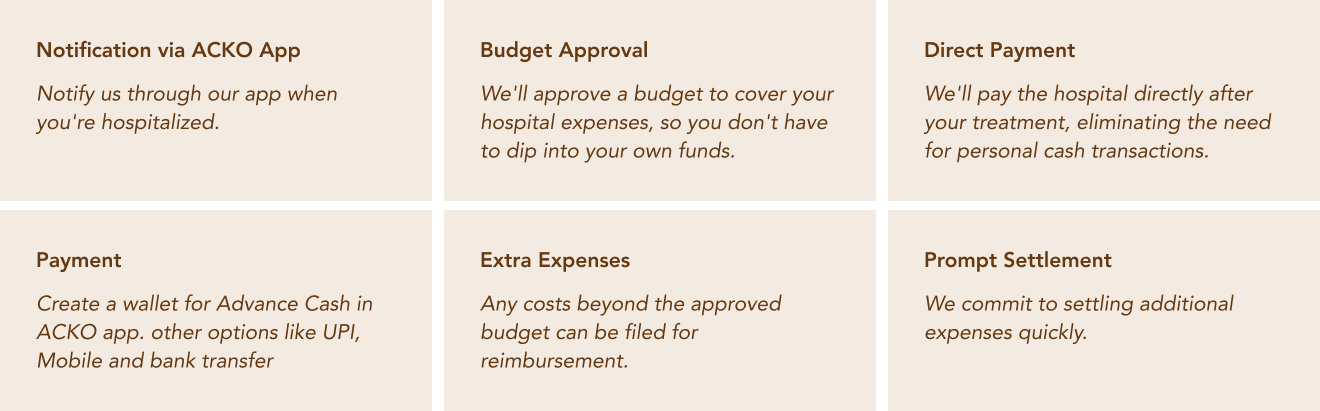

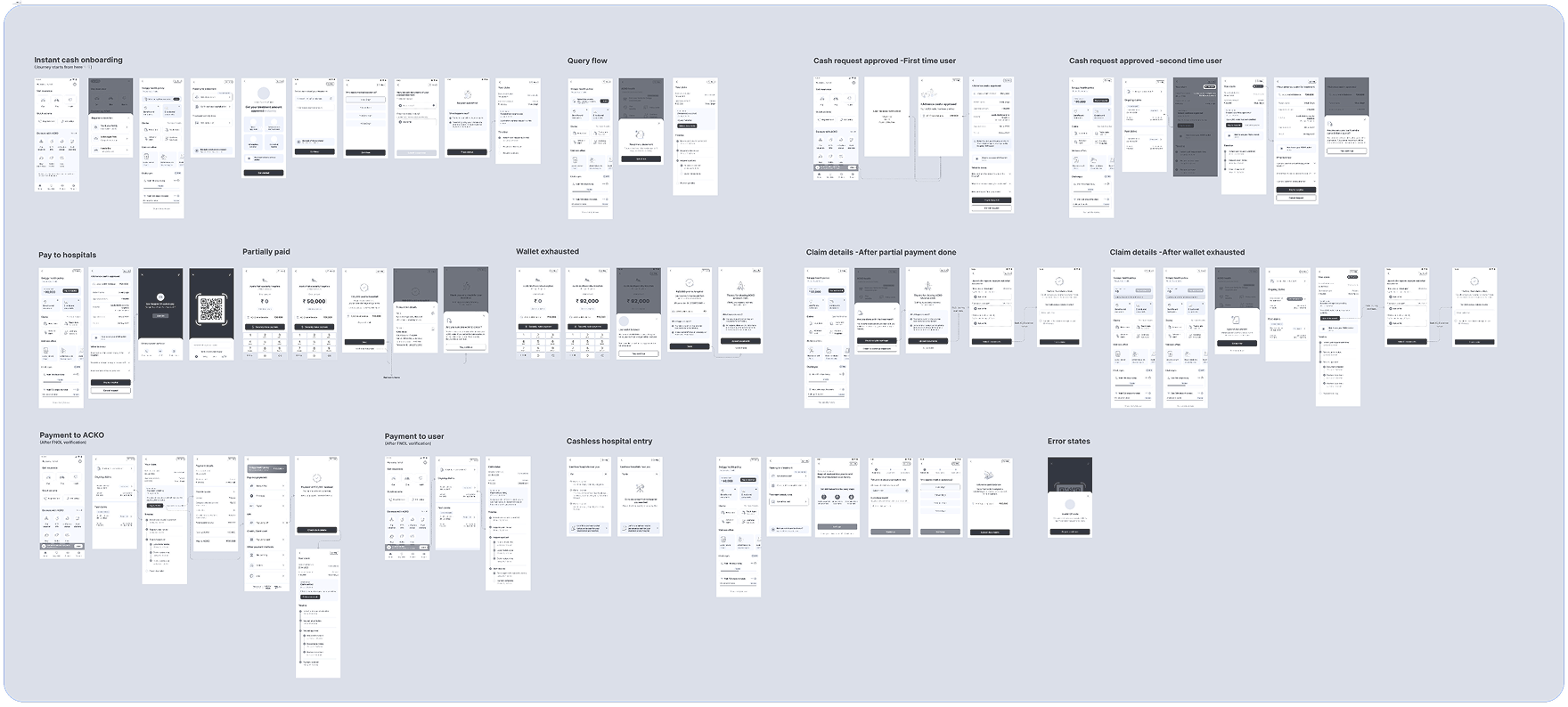

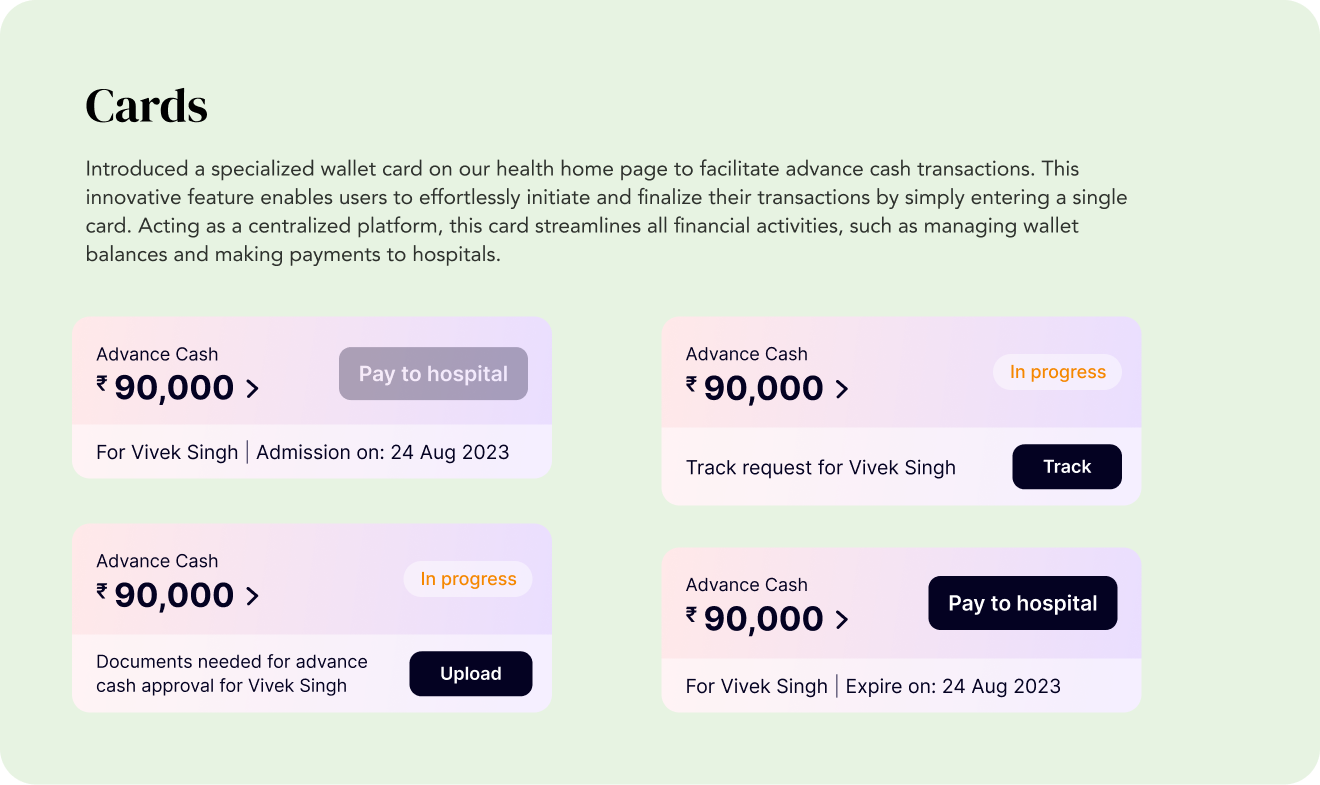

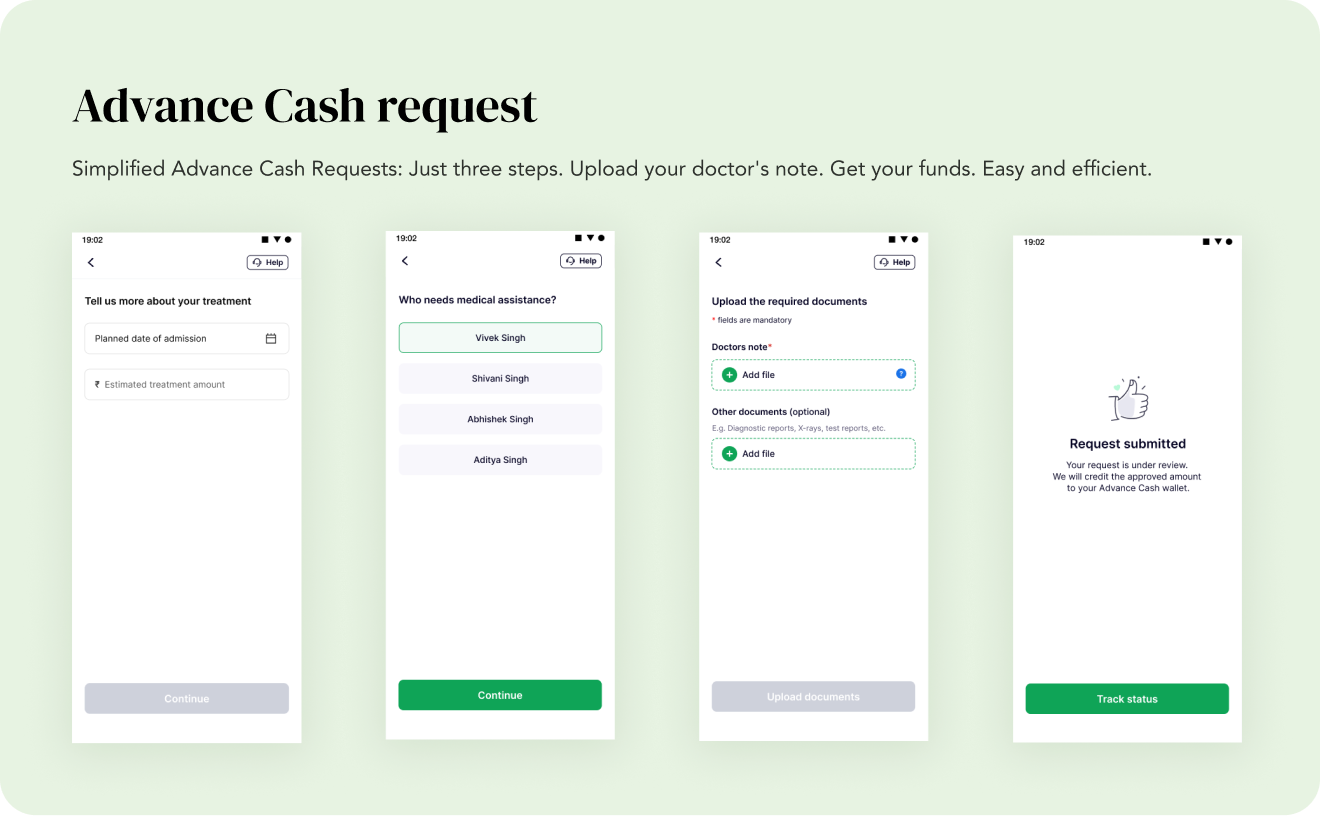

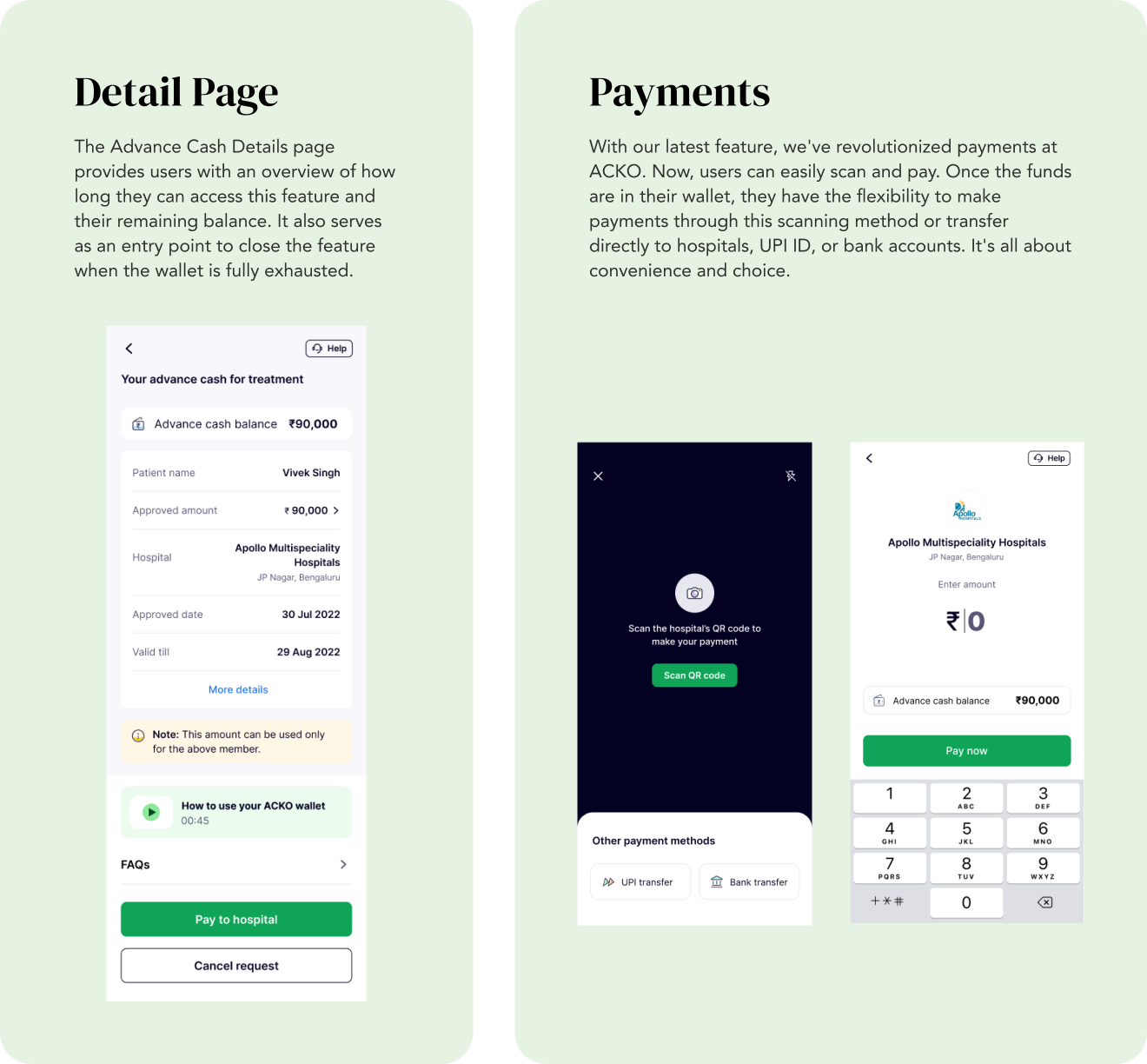

Acko proposed a solution that focused on planned hospitalizations with an initial estimated amount of up to 1 lakh INR, accounting for 30% of current cashless claims (15% of overall claims). Emergency hospitalizations would still follow the traditional cashless processing. However, 24x7 support for pre-authorization and customer experience could potentially expand the coverage to approximately 50% of all claims.

The proposed solution included:

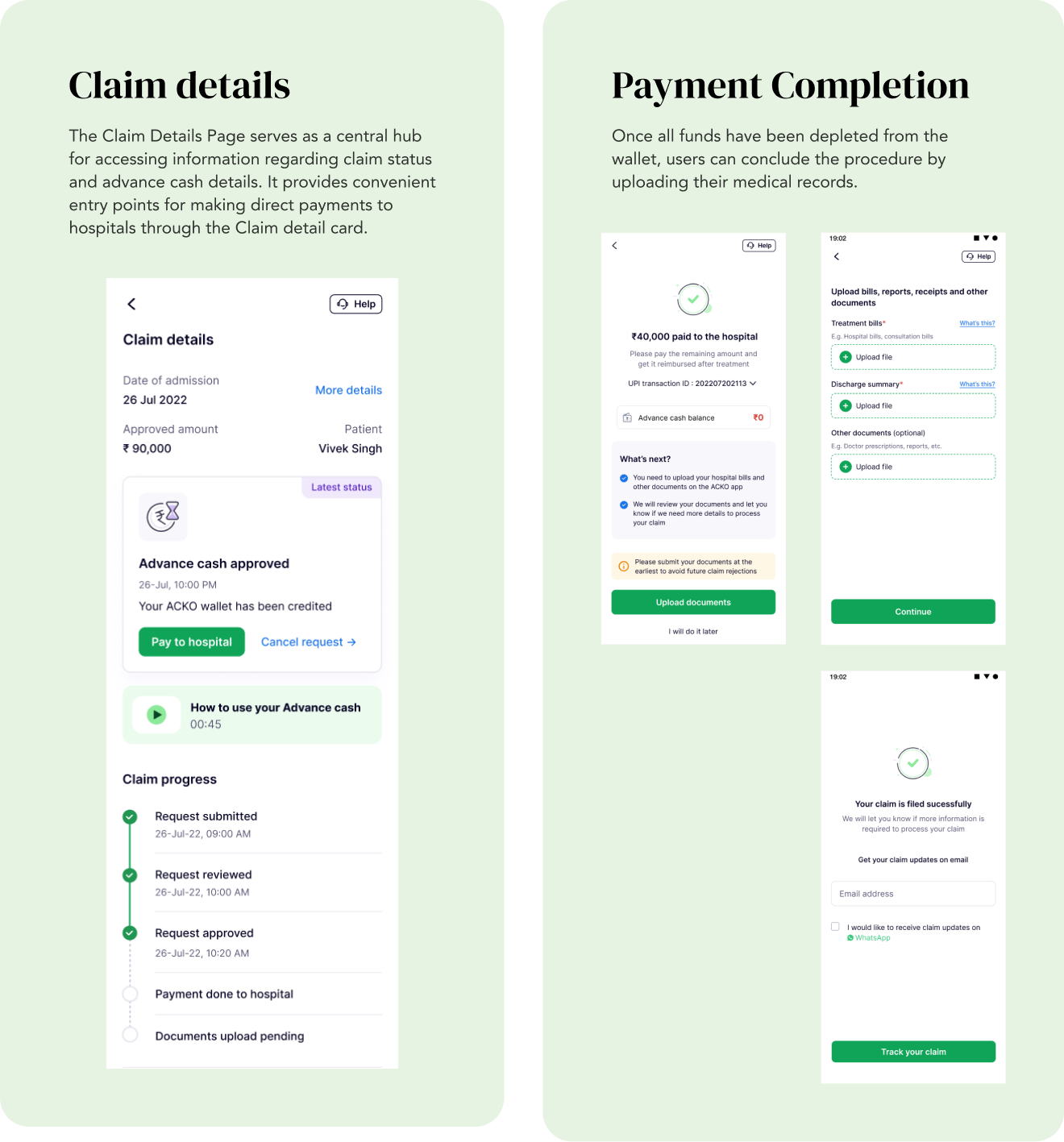

The feature is launched to corporate policy customers in the pilot phase. The initial impact was positive with engagement metrics showing 4,653 users checked this feature.

MAU in the month of May to June: 25 Users

Highest requested amount is 1,20,000 in which we released 80,000

Total request 261

Overall request increased to 25.48% from 41.2% in August to September

Led the efforts to completely redesign the application, solving existing UX gaps and enabling further business growth.

Read More

Connect with residents in your community to share updates, discover shared interests, and support one another beyond official announcements.

Read More

Design has always evolved alongside technology. From physical tools to digital software, each shift changed how designers think, collaborate, and create. AI marks the next major transition not as a replacement for designers, but as an active collaborator.

Read More